Voice of the Client Survey Toolkit

|

||||||||

|

|

||||||||

Your clients have the answers - you just need to ask them. |

||||||||

|

Who’s suitable to participate? If you base your operations in North America and your organization is one of the following, you would be most likely to benefit from participating in this survey:

|

||||||||

| Fill out an interest form | ||||||||

|

|

||||||||

|

Why it's important to hear the voice of your clients through a client survey |

||||||||

| Client expectations are higher than ever – and the competitive landscape is more crowded. A robust client insight strategy is the difference between falling behind and leading the pack. The most reliable and objective method of gathering actionable client insights is a client survey. Surveys give you the feedback you can’t get from one-on-one interactions. They unearth what your clients are feeling but might be too afraid to say, and how they see your business now and in the future. |

||||||||

|

|

|||||||

|

Not asking them is sending you down a path of disengagement. This is the single best thing you can do for your client experience." |

||||||||

|

We recently sat down with Colin Brooks, Vice President & Trust Officer at Sawmill Trust Company, to discuss how client feedback surveys have been an important element of their firm's client experience strategy — and why they chose to leverage the Alliance Client Survey Toolkit this time around. |

||||||||

Why use our Client Survey Toolkit? |

||||||||

| Simply put, we gathered the best minds in the business to craft the best possible survey tool, specifically tailored to the needs of family wealth firms. Then we made it easy to use, affordable, and customizable. And we're packaging it with never-before-seen industry benchmarking in the form of our Voice of the Client in Family Wealth: Industry Benchmarking Report. | ||||||||

|

||||||||

|

|

|||||||

|

|

Eric AlmquistPartner, |

|

Brian Kostick, CFP®Managing Director, |

|||||

|

|

|||||||

|

|

Andrew BusserPresident, Family Office |

Kristi CombsManaging Director, Client Relations |

||||||

|

|

|||||||

Drew McMorrow, CFP®President & CEO

|

|

Michael ZeunerManaging Partner |

||||||

|

||||||||

|

Dynata is the world's largest first-party data and insights platform, with more than 40 years’ experience as a pioneer in consumer and B2B insights. They've helped more than 5,500 organizations around the world and in every industry find and accelerate the right insights to market, enable better decision-making, and deliver revenue growth.

|

||||||||

Comprehensive and innovative metrics |

||||||||

|

|

|||||||

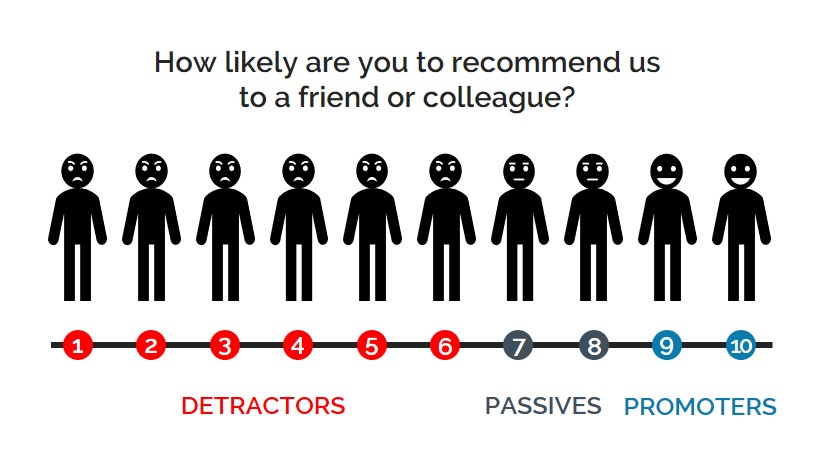

Net Promoter Score (NPS)Net promoter score has been shown to be one of the best predictors of an organization's top line growth. NPS helps businesses evaluate the quality of their client service (particularly in relation to the market), monitor trends, and increase revenue through client referrals. |

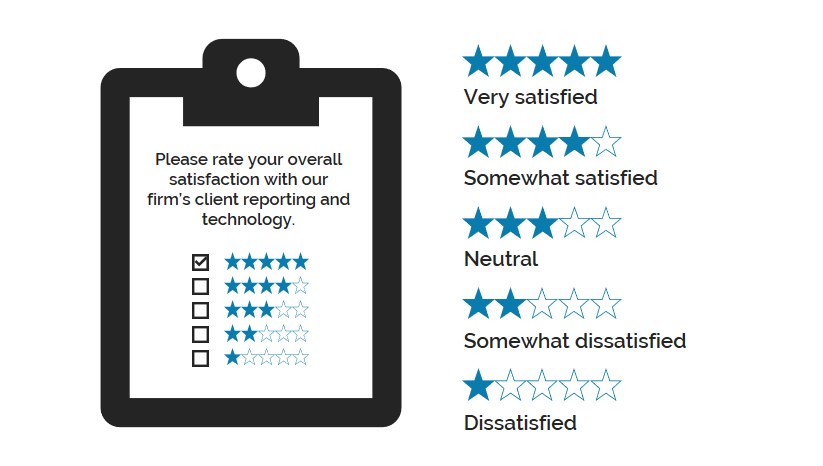

Customer Satisfaction Score (CSAT)No metric is more closely correlated with long-term, sustainable business growth than client satisfaction. CSAT gauges how satisfied a client is with specific service areas, dimensions, or interactions. Customizable questions form an in-depth analysis of your firm's strengths and weaknesses. |

|||||||

|

|

|

|||||||

|

|

Bain's Elements of Value®Value is rooted in human psychology. Based on research with more than 190 companies across 22 categories, Bain & Co. has identified 30 Elements of Value that lift brand propositions above commodity status. They’ve proven that delivering more elements yields higher NPS, revenue growth, and share gain. Learn more. |

|

ConfidentialityThe Client Survey Toolkit is specifically designed for firms that require the highest level of security and confidentiality. Client responses are processed anonymously and no identifiable client data is given at any time. All research parties are protected under a strict Letter of Agreement.

|

|||||

| Managing the Elements of Value Eric Almquist, a partner in Bain's Customer Strategy & Marketing practice, discusses 30 elements of value at work in the marketplace and how companies that deliver more of these elements have higher growth and more customer advocacy. © Bain & Company, Inc. |

||||||||

What's included in your Toolkit |

||||||||

|

|

|

|||||||

Ready-to-use, customizable surveyA pre-built online client survey, branded with your logo, plus an option for phone administration. Your firm will have the opportunity to add, modify, or remove questions from the survey. Once customized, the client survey is ready for your firm to disseminate. Your firm, under your brand, will be the only ones reaching out to your clients. |

Communication templatesKeep advisors, relationship managers, and clients informed and engaged during the survey process. Craft your own communication strategy, or start with our templates and recommended cadence. It's up to you. |

|||||||

|

|

|

|||||||

Raw survey dataComplete access to your firm's raw data for processing, analysis, and review. Note: Survey responses are anonymous to ensure confidentiality and transparency - your firm will receive all client responses in full, but you won't know which clients provided them. |

User-friendly dashboardAn online dashboard to monitor engagement levels and see your client feedback come to life in real time. Response data is automatically translated into insightful charts, graphs, and tables - we've done all the work for you. |

|||||||

|

|

|

|||||||

Topline summaryDelivered four to six weeks after your survey closes, a dedicated research analyst will process your data and provide a short summary of key metrics, insights, and implications to guide the interpretation of your results. |

Industry benchmarking reportHearing the voice of your clients is powerful, but knowing how you compare to peers and the overall industry provides an even greater advantage. That’s why, in addition to receiving results for your firm, you will receive the Voice of the Client in Family Wealth: Industry Benchmarking Report. |

|||||||

|

|

||||||||

Pricing |

||||||||

|

Family Wealth Alliance Members: $6,000 |

||||||||

|

Price includes:

* Delivery contingent on minimum participant thresholds |

||||||||

Create your own user feedback survey

Schwab Advisor Services™ serves independent investment advisors and includes the custody, trading and support services of Charles Schwab & Co., Inc. (Schwab), member SIPC. Independent investment advisors are not owned by, affiliated with, or supervised by Schwab.

This is a sponsored feature developed by Family Wealth Alliance and supported by Charles Schwab. Family Wealth Alliance is not affiliated with The Charles Schwab Corporation. Family Wealth Alliance will share your information with Sponsor, Charles Schwab & Co., Inc. Schwab may use it to contact you and to send you additional insights from Schwab Advisor Services™. Read about privacy at Schwab at www.schwab.com/privacy.

©2021 Charles Schwab & Co., Inc. (“Schwab”). All rights reserved. Member SIPC.

0621-1HP9 (06/21)